Look at your pricing with the help of our Virtual assistant Loan calculator

Should you decide to find a home and you are eligible for new Va Financing, you’ve got the possibility to take advantage of among greatest financial sale in the market.

Exactly why are the newest Va Loan the best home loan deal available everywhere? The newest Virtual assistant guaranty. This new U.S. Company regarding Experienced Points even offers an excellent Va guaranty, which handles loan providers for example you. Providing you with you justification to offer you beneficial terms toward your home financing.

Benefit from the masters.

- Zero down payment is huge when you compare the fresh Va Mortgage so you can most other mortgage loans. During the family closure, many pros shell out absolutely nothing in order to nothing up front.

- Spend shorter.

- Va Funds include down rates as compared to other domestic funds. They do not have private financial insurance policies (PMI) both. You save money or can even afford to pick a very high priced set.

- Become approved versus a hassle.

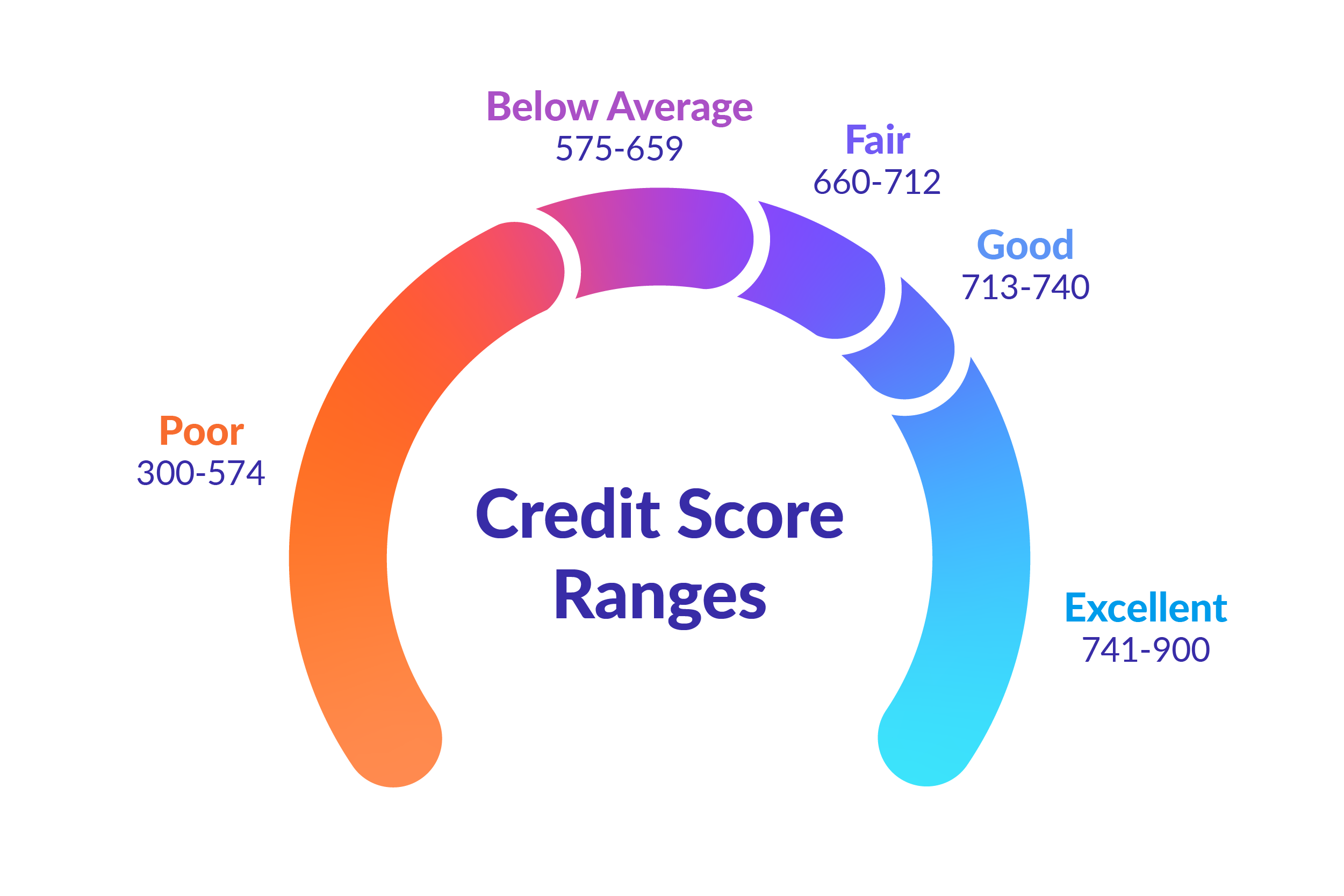

- You don’t need to very first-rate credit. We accept credit ratings as little as 500. On the other hand, a case of bankruptcy or foreclosure would not instantly disqualify you.

You safe and you may offered our country. At least we are able to perform are make it easier to purchase your household. Look at the Va Financial cost over to see how we can help you begin, Should you want to chat first, phone call our Va Mortgage team now at 855-610-1112 .

Around three basic steps to getting their Va Loan.

Remark your own Certification of Qualification (COE) and check the Virtual assistant Mortgage qualification. In case the COE claims this veteran’s basic entitlement try $thirty-six,100000, you can aquire a home for $484,350 with no down-payment.

Score pre-accepted online and found your own Approved Customer Cert . With this before you could search for a home, you are able to replace your settling energy.

Click-to-indication and pass on certain help data files by logging into the Mortgage Dashboard where you can look at the loan standing, closure plan, and you will very important documents.

We offer you towards Closure Disclosures and you will probably would good finally stroll-through of the house and you may confirm the seller will start the property for you as the concurred.

Following possessions legitimately transmits from the former holder to you personally and also you indication all of your finally financing records, you get the fresh new keys to your household!

Know how to benefit from every Virtual assistant Mortgage gurus even as we walk you through the house to buy procedure in our 100 % free step-by-step book.

„A class actually. Lee and you may Jessica got our financing closed-in 2 weeks! They generated the complete processes basic straightforward. Thank you much!” – Benjamin W.

„An absolute pleasure to partner with. I’ve purchased a couple belongings today that have NewCastle and you may refinanced other big date. Someone during the NewCastle are ready to go that step further to own your.” – Abraham K.

„We read from our family relations how much time and you will exhausting the process is but NewCastle loan they produced what you simple and you may were there for every single action, Jessica was an educated, responded to my email inside in a minute, and you may answered all the question I had.” – Britney Yards.

Virtual assistant Financing FAQ

No. Just is it possible you not spend the money for Va financing payment, you can also be eligible for possessions income tax exemptions based a state/state. Likewise, in your COE it can establish even in the event you would like to pay this new Va Financing percentage.

Sure! To help you know if you could reuse your own Virtual assistant benefit for a financial loan more often than once, you ought to figure out their Va entitlement, kept entitlement, and the ways to go about fixing entitlement for purchasing with a Va Mortgage loans Marble CO again and for several Va financed characteristics. You can aquire everything you want right here.

Active , we can predict changes on Va Mortgage, mortgage limit and possibly a great many other areas of how Va Funds are believed. Yet not, the fresh Dept. out of Seasoned Products has not granted the new strategies for those things will be different. When they would, we’ll express the new information.

The fresh Va urban centers plenty of conditions to your apartments in addition to their connections so that make use of your Virtual assistant Mortgage work with buying a flat. It continue a current searchable number here to the Virtual assistant website out of recognized condominium advancements.

If a flat we want to pick is not on the site, ask us to obtain the condominium development accepted. Yet not, the method can take around two months. And, new condominium could be grandfathered inside the when it are accepted previous in order to .

We’ll you need numerous records about condominium organization, known as the Condo’s Business Data files. These types of documents become: Current financial and you may legal actions declaration; Report from covenants, conditions, and you can limitations; Resident relationship bylaws and funds; Times of the past two citizen organization group meetings; Plat, Map/Sky lot survey; and you may Special analysis and you can litigation report.

- At least 50% of your devices must be filled of the residents.

- 85% or maybe more of the people are on date with regards to HOA expenses.

- To have newly built condos or systems has just converted from accommodations, at the very least 75% of one’s equipment need to be offered.

- Zero restrictions is generally a citation from reasonable casing and you may lending regulations (inquire us to own details).

Va Financing are almost always an educated mortgage alternative. Find lower than to have a snapshot so you’re able to just how good Va Loan measures up for other alternatives (intentionally omitting any possessions insurance coverage, possessions fees, and/or HOA fees, when the relevant). Contained in this example, the audience is assuming our home are $300,100, you meet with the minimum borrowing from the bank criteria, provide at the most a 10% downpayment, and reduced monthly home loan insurance rates (if the applicable):

In the graph a lot more than, good Va mortgage is the clear choice when investment a home purchase. However, if for example the particular disease dictates employing another mortgage service.

Regardless of the sort of assets you’re thinking about, all functions need see Va Lowest Possessions Standards (MPR) and get made use of as the a primary quarters. The fresh new MPR fundamentally claims the home have to be safer, sanitary, and you can structurally sound. This will come up for the Virtual assistant appraisal out-of property, however your real estate agent will be able to choose biggest situations before buying so it.